Changes Affecting Rules for Retirement Savings and IRA Distributions

April 21, 2022

Overview:

In what seems like much longer than just over two years ago, the Setting Every Community Up for Retirement Enhancement Act (SECURE Act) was passed by Congress and signed into law on December 20, 20191. It was a significant piece of legislation that, among other things, created an easier and more cost-effective pathway for more small businesses to offer employer-sponsored retirement plans to more employees, including reduced eligibility requirements for part-time employees as well as non-employee contractors. Clearly this was a positive development, and one geared towards “setting up” more Americans for retirement through greater access to the advantages of employer-sponsored retirement plans.

The overarching goal of Congress to help facilitate more savings, by more Americans, into retirement plans continues its momentum. On March 29, 2022, the House voted on a bill that passed with a sweeping majority of 414 to 15 entitled the Securing a Strong Retirement Act2. This bipartisan bill is an effort to build upon the SECURE Act of 2019 and is widely being referred to as “SECURE Act 2.0”3. Ahead of the March 29th House of Representatives vote, Chairman Richard Neal of the House Ways and Means Committee offered his perspective on the bill when he articulated the well-known fact that “Too many workers reach retirement age without having the savings they need.” 4 Chairman Neal further offered his support for the bill, stating that “H.R. 2954 will help all Americans successfully save for a secure retirement by expanding coverage and increasing retirement savings, simplifying the current retirement system, and protecting Americans and their retirement accounts.”

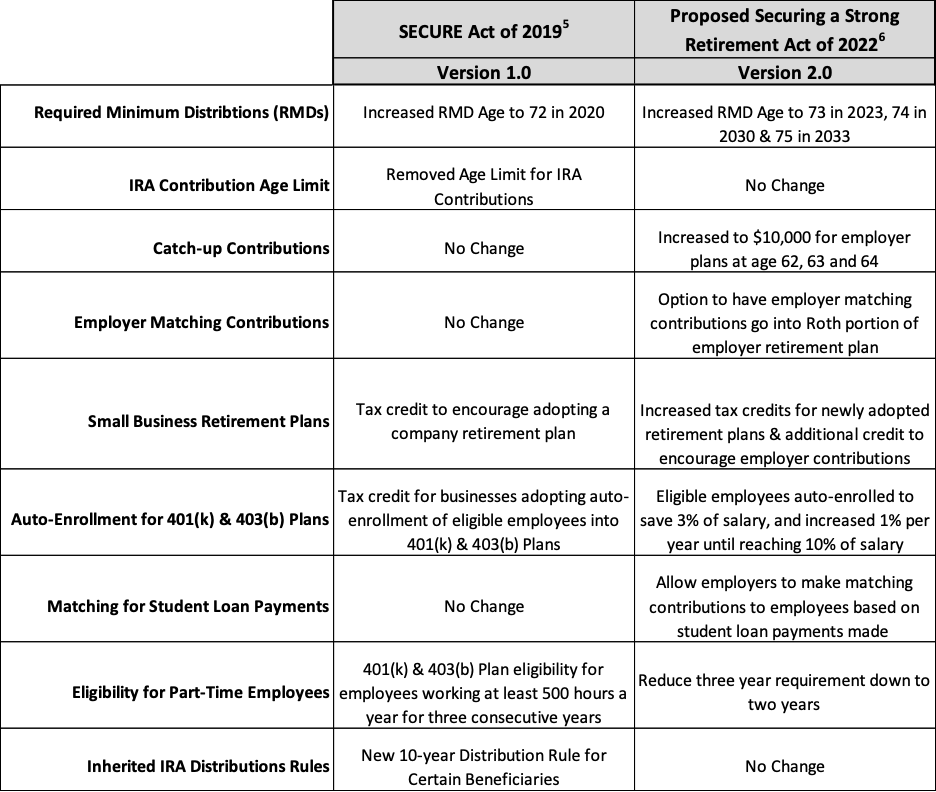

As the passage of the SECURE Act of 2019 brought changes to both employer-sponsored retirement plans and IRAs, the proposed 2.0 iteration currently working its way through the legislative process would create additional rule changes as well. With that backdrop, let’s look at some of the provisions already signed into law compared to those under consideration with the 2022 bill now with the Senate:

Comparison of SECURE Act of 2019 & Proposed Securing a Strong Retirement Act of 2022 (SECURE 2.0)5,6

End of an Era – The “Stretch IRA” is Eliminated

One of the most significant and widely publicized changes brought on by the SECURE Act pertains to the distribution rules for IRA beneficiaries who inherit an IRA after the account owner passes. Prior to the SECURE Act of 2019, anyone with inherited IRAs had to take an annual Required Minimum Distribution (RMD), but the RMD was based on their own age instead, and not that of the deceased IRA owner.

This concept became ubiquitously known as the “Stretch IRA” as it allowed individuals inheriting IRAs the option of “stretching out” the RMDs over their lifetime, and then their beneficiary’s lifetime, and so on. As such, it took much longer (often a few generations) for the IRA assets to be depleted, and income taxes paid. However, under the SECURE Act of 2019, most beneficiaries who inherit an IRA from an account owner who passed away on 1-1-20 and later will be subject to the new 10-year accelerated distribution rules, and therefore not able to “stretch” their distributions.

There are a few beneficiary categories that are exempt from the new accelerated 10-year distribution rules. The following beneficiary-types can continue to take RMDs based on their own age and, except for the category of minor children, can also spread the RMDs over their own lifetimes7.

- The surviving spouse of the deceased IRA owner, which is the only type of beneficiary that can choose to take ownership of the IRA of the decedent, or they can choose to hold it as an Inherited IRA depending on what is most advisable for their situation.

- An individual who inherits an IRA and is not more than 10 years younger than the decedent (e.g., a sibling), is also exempt from the new distribution rule.

- Individuals who are deemed disabled or chronically as defined by IRS guidelines, are also allowed to take RMDs for the remainder of their lives.

- Minor children who inherit an IRA can take RMDs based on their own age. However, they may do so only until reaching age of majority, at which point they too are subject to the new 10-year distribution rule.

The new IRA distribution rule brought on by the SECURE Act of 2019 is widely referred to as the “10-year rule”. As originally stated, the rule dictates that beneficiaries inheriting an IRA in 2020 and beyond (who are not members of one of the exempt categories above) must fully deplete the inherited IRA within 10 years of receiving it. There are no other requirements in terms of RMD calculations or life expectancy considerations8.

However, from inception there had been confusion and uncertainty around how beneficiaries are supposed to meet the requirements of this new 10-Year Rule. Initially, many interpreted the 10-year rule to mean that all beneficiaries could decide whether to distribute all of it in the first year, spread distributions out over the 10 years, defer distributions entirely until the 10th year, or any other combination of distribution intervals as long as it resulted in a $0 balance for the Inherited IRA by the end of the 10th year after receiving it.

But we have a new twist as of February 23, 2022, when the IRS issued Proposed Regulations that would change how the 10-year rule is met by certain beneficiaries. The amended regulations under consideration indicate that those who inherit an IRA after the account owner reached their Required Minimum Distribution beginning date (age 72 in 2022) will need to take (at least) their own Required Minimum Distributions in years 1 through 9, with full depletion by year 10.9 Whereas beneficiaries inheriting an IRA before the account owner reached their Required Minimum Distribution beginning date will still be able to distribute over the 10-year period in whatever increments deemed most advantageous for their situation10.

The IRS Proposed Regulations would also bring clarity as to how the 10-year rule affects trusts named as IRA beneficiaries. The SECURE Act of 2019 initially seemed to completely upend existing plans using trusts as IRA beneficiaries to the point where these trust documents needed to be amended by an estate attorney. However, the new proposed regulations would remove the ambiguity regarding trusts as beneficiaries brought on by the SECURE Act of 2019. This in turn would allow for these trusts to remain in place without needing to be amended and still qualify for the 10-Year Rule distribution requirements as described above11.

Closing Thoughts

The efforts by Washington regarding employer-sponsored retirement plans as highlighted in the comparison chart above are clearly geared toward increasing the availability of these plans to more Americans through tax incentives for small businesses. The “SECURE Act 2.0” changes also seek to help mitigate potential inertia of eligible employees through auto-enrollment. These are all very positive steps toward facilitating retirement preparedness for more Americans. Additionally, the removal of the age 70 ½ limit for IRA contributions is befitting to the trend of many individuals choosing to work in some capacity beyond traditional retirement age.

Although the benefits introduced are welcomed, we must remain mindful of the implications attributed to those reciprocal rule changes meant to fill the tax revenue side of the equation, such as the insertion of the 10-year distribution rule. This change greatly accelerates the pace of IRA distributions (and their taxation) for certain beneficiaries, with the biggest impact on adult children inheriting their parents’ IRAs, who are also often in their prime earning years. As such, an interesting stat on the 10-year rule is the estimate that approximately $15.7 billion of increased tax revenues would be generated between the years of 2020 and 202912.

If you should have any questions about the SECURE Act of 2019, the developing “SECURE 2.0”, or the new IRS Proposed Regulations, please do not hesitate to contact your GYL Wealth Advisor.

CAR20220422TLIC

1 Bloomberg Tax, INSIGHT: Planning Considerations Regarding the SECURE Act.

2 Financial Advisor, House Passes SECURE 2.0 With Provision Raising RMD Age To 75.

3 Pension & Investments, House Passes SECURE 2.0 Bill.

4 CNBC, House Passes ‘SECURE Act 2.0’. Here’s What it Means for Retirement Savings.

5 The CPA Journal, The Secure Act Ushers in Sweeping Retirement Plan Changes.

6 Financial Advisor, House Passes SECURE 2.0 With Provision Raising RMD Age To 75.

7 New York Times, IRA Rules Have Changed and Heirs Need to Pay Attention.

8 New York Times, IRA Rules Have Changed and Heirs Need to Pay Attention.

9 IRAhelp.com, SECURE Act Regulations Are Here.

10 ThinkAdvisor.com, IRS’ Secure Act Guidance on RMDs Has a Surprise Twist.

11 IRAhelp.com, SECURE Act Regulations Are Here.

12 Congressional Research Service, The SECURE Act and the Retirement Enhancement and Savings Act Tax Proposals (H.R. 1994 and S. 972).