Beware, Equity Rates of Return Are Likely to Moderate Over the Next Decade

May 8, 2024

Long-term return expectations are the cornerstone of any sound financial plan. Shifting our focus from short-term noise, this article delves into the long-term outlook for equities. Our analysis suggests that, over the next 10-20 years, stock market returns may be lower than what investors are expecting and have historically experienced. Our analysis indicates that the equities are likely to generate sub-par rate of return relative to history.

In a world fueled by social media, our views are often driven by the “headlines,” that usually just reinforce our prevalent mindset, without challenging our thoughts and analysis. We as Investors are not different. This constant newsfeed drowns out long-term thinking, leading to impulsive choices. In this piece, I would like to break free from this noise and instead of focusing on short-term drivers (earnings, Fed policy, elections, current geopolitical situation, etc.) focus instead on the really long-term.

Yes, “predicting” the future, especially market gyrations, is a fool’s errand, and chasing short-term market whims is demonstrably futile. However, every investment strategy is built on some implicit model of the long-term future, and fortunately we can leverage powerful long-term forces that constraint potential outcomes, and shape the economy and financial markets, such as: demographics, productivity, valuation and real interest rates.

While perfect accuracy remains elusive, long-term models built on these fundamental factors can be far more reliable than short-term forecasts and allow us to manage risk and make sound asset allocation decisions. Now, long-term does not mean perfect: Even strong models can’t account for unpredictable events (such as wars, or pandemics), but they can help manage risk and guide asset allocation.

So, let’s look at the long-term trends…

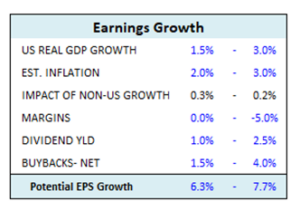

1. Top-Down: The U.S. is unlikely to grow above 2.5% in real terms over the next 10-20 years, and with corporate margins at close to peak levels, even with the contribution of elusive global growth, EPS real growth (net of inflation) is unlikely to be above 4-5%* …

*Assumes global growth averages 2.5-3.5%, and contributes 25-35% to S&P corporate profits.

Source: Bloomberg

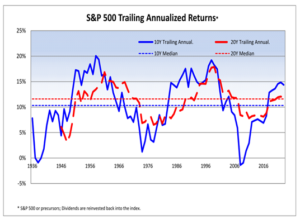

2. Reversion to the mean: The trailing 20 year annualized return seems over-extended…

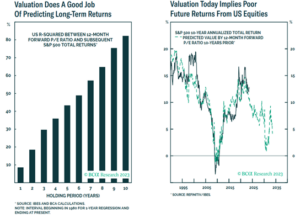

3. Market valuation tells us very little about the expected return in the short-term, however it is highly correlated with the returns over the long-term. Today’s 20-22x earnings multiple has been associated with 4-7% return over the next 10 years…

4.

… Moreover, relative to U.S. GNP, the U.S. has been looking OVERVALUED for a while… How fast can valuation run away from the economy?

Source: Bloomberg

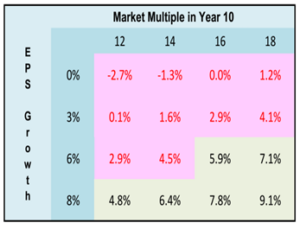

5. Equities versus Bonds: there are fewer scenarios where EQUITIES are likely to outperform BONDS*…

*Assumes bond yields = 10Y government bond yield + 100 bps Bonds yield Assumes global growth averages 2.5-3.5%, and contributes 25-35% to S&P corporate profits.

Source: Bloomberg

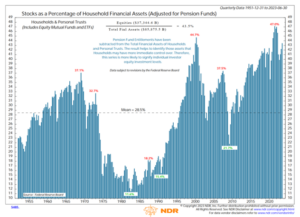

6. Flows: investors’ holdings of equities are close to peak levels…

Source: Ned Davis Research (NDR)

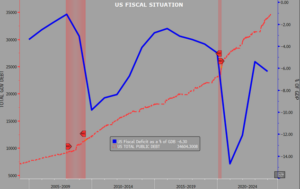

7. A BIG HEADWIND: U.S. Fiscal situation should be a big headwind over the long term. The graph illustrates why there are real questions about the sustainability of this situation, even without considering Social Security and Medicare liabilities, or the impact of increasing interest expense over the next several years…

Source: Bloomberg

8. Finally, the BIG PICTURE: for some reason, investors’ financial memory tends to focus on the last 20-25 years. As shown above, the past 20-30 years have been particularly positive for financial markets and rates of return. Can the next 20 years match the recent history?

| LONG-TERM EQUITY RETURN? | |

| 1980-2020 | 2020-2040 |

| + Starting point: low valuation

+ Starting point: high inflation / high real rates + Starting point: high taxes + Starting point: high regulations + Starting point: low corporate margins + Starting point: low leverage + Starting point: individuals had a low percentage of financial assets invested in equities. + During the period: back to capitalism (Reagan, Thatcher) + During the period: increased globalization. + During the period: end of the cold war. Eastern Europe, Russia, & China joined the western world |

– Starting Point: high valuations

– Starting Point: low interest rates / low inflation – Starting Point: taxes rising – Starting Point: regulations increasing. Activist governments – Starting Point: high corporate margins – Starting Point: high government debt & higher leverage – Starting point: individuals have a high percentage of their net worth invested in equities. – Starting Point: rising anti-capitalism sentiment – Starting Point: de-globalization – Starting Point: increasing geo-political tensions |

| ANNUALIZED RATE OF RETURN = 9-11% | RATE OF RETURN=? |

Looking at long-term trends, and constrains we expect rates of return for equities to moderate considerably over the long-term. Of course, outcomes are probabilistic, but given the current information, and outlook, we believe it is improbable that U.S. equities will match the performance of the past 10-30 years. Financial planners beware…

Aaron Cohen

Co-Founder and Managing Director

Disclosures:

The views contained in this presentation represent the opinions of GYL Financial Synergies, LLC as of the date hereof unless otherwise indicated. This and/or the accompanying information was prepared by or obtained from sources GYL Financial Synergies, LLC believes to be reliable but does not guarantee its accuracy. The article is not a complete analysis of every material fact in respect to any security, mutual fund, company, industry, or market sector. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. This document contains forward-looking statements, predictions and forecasts (“forward-looking statements”) concerning our beliefs and opinions in respect of the future. Forward-looking statements necessarily involve risks and uncertainties, and undue reliance should not be placed on them. There can be no assurance that forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Past performance does not guarantee future results. CAR20240503ACFRR