Tik, Tok… Boom? The State of U.S.-China Relations

March 27, 2024

By Gerald B. Goldberg, JD, CIMA®, CEO, and Co-Founder

On March 13th, the U.S. House of Representatives overwhelmingly approved legislation that would force ByteDance, the Chinese parent company of social media platform TikTok, to divest the app on national security grounds. With Beijing signaling its unwillingness to approve any sale of the app to a foreign buyer, passage of the bill by the Senate would likely mean a nationwide ban on TikTok.1

This episode certainly brings up important discussions around misinformation, free speech, and the threat of foreign influence to our democratic process. But viewed in context, this bill is just the latest skirmish in the tense bilateral relationship between the U.S. and China. While rhetoric between the two superpowers softened after a November summit last year, a rare bipartisan consensus has formed in Washington that recognizes China as a strategic global competitor, if not an outright foe.2

Significant efforts have already been made to decouple the two economies, especially in politically sensitive areas. In the wake of sanctions against Chinese technology firm Huawei, the Biden Administration has approved bans on private American investment in certain Chinese industries as well as restrictions on high-end computer chip exports to the country.345 For their part, China has introduced reprisal measures, including barring the use of iPhones for government work.6

While there is always a risk that protectionism and competition spill over into open conflict, the two superpowers have also shown the ability to cooperate when their interests align. In the last few years, China has emerged as a partial guarantor of the continued shipment of oil through the conflict-ridden Strait of Hormuz, a role historically exclusive to the American military.7 Further, the Biden Administration recently reaffirmed America’s “one China” policy, which seeks to maintain regional stability by declining to officially recognize the sovereignty of Taiwan.2

While no individual economic measure implemented thus far are substantive threats to China’s economy, they do demonstrate that a souring political relationship may undermine the extent to which the country can rely on U.S. imports and investments to fuel growth. Moreover, they come at a time when China is already grappling with a number of serious economic headwinds, thus creating a complicated outlook for the world’s second-largest economy.

China: Challenges Long in the Making

To understand some of the current challenges facing China, some historical context is useful.

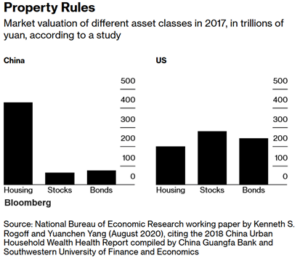

During the late 20th century, China underwent an unprecedented industrialization process, evolving from an agricultural economy to the global leader in manufacturing output in the span of just 35 years.8 Among other impacts, the rapid modernization of the economy triggered a construction boom, with the flood of workers into cities creating demand for both residential and industrial property. China’s real estate market quickly became a major contributor to growth, at times driving as much as 20% of its economic activity.9 In addition, property became a key investment for the nation’s growing middle class, with housing wealth far outstripping holdings of traditional financial assets.10

But behind the scenes, much of this growth was fueled by the rapid accumulation of debt. By 2020, China’s real estate developers were carrying an estimated $5 trillion in liabilities, equivalent to more than a quarter the size of the entire Chinese economy.11

In their efforts to forestall a more serious meltdown, Chinese officials attempted to “prick” the debt bubble with several new regulatory measures in 2020.12 But the new rules may have done more harm than good; as of last year, more than half of China’s top 50 developers had gone into default, dragged down by falling home prices and a cooling debt market.13

As the real estate sector muddles through its slow-moving crisis, China’s economic woes are being exacerbated by the long-term effects associated with the government’s heavy-handed approach to curbing Covid.14 Although strict lockdowns have largely been lifted, consumer spending remains anemic and youth unemployment exceeds 15%.15 At the same time, demographic issues associated with China’s erstwhile one-child policy have started to rear their head, creating significant questions surrounding the size of the nation’s future workforce.16

Markets are already reflecting the pain. The Shanghai Composite (an index of all stocks on China’s main exchange) fell to a five-year low in early February.17 Despite a slight comeback since then, a true recovery has yet to materialize, prompting the government to explore a state-backed stabilization fund to prop up the market.18

Of course, it would be wrong to write China off completely. The nation’s economy still grew by more than 5% in 2023, greater than both the global average and the American economy during the same period.19 But this growth needs to be understood in the context of China’s challenges – especially when the outlook for other international markets is comparatively brighter.

The International Valuation Gap

One way to understand market valuations is through the price-to-earnings (P/E) ratio, which measures how much investors are willing to pay for a dollar of current earnings. A historically high overall P/E ratio reflects bullish growth expectations, while a lower one tends to be more pessimistic.

Based on this logic, a recent JPMorgan Asset Management report revealed that investors are far more confident about U.S. business prospects than those of the rest of the world.20 While the S&P 500 registered a P/E ratio of 19.5x, the ACWI ex-U.S. (a broad index of developed and emerging markets outside the U.S.) hit 12.9x.

While it is not uncommon for investors to favor America’s traditionally business-friendly environment, the scale of that preference has grown in recent years. Today, the gap between U.S. and non-U.S. P/E ratios has risen to two standard deviations above historical levels, a profound increase from the long-term average.

Unsurprisingly, the primary driver behind this gap is U.S. outperformance. Over the past 15 years, the S&P 500 has logged annualized returns of 14%, compared with just 7.2% for the ACWI ex-U.S. But an overlooked contributor, and one that may soon reverse, is the current strength of the U.S. dollar.21

On the back of the Fed’s aggressive rate hikes, investor capital has flowed into the U.S. in pursuit of high-yielding assets. That dynamic has increased the demand for dollars, pushing the DXY (an index of the dollar against a basket of other currencies) up 12% in the past three years. But with rate cuts on the horizon, the gap between U.S. and international valuations could be primed for a reversion to the mean.22

While inflation did pick up slightly in early 2024, the Fed once again chose to keep rates steady at their most recent meeting on March 20th.23 Moreover, official forecasts predicted three rate cuts over the course of the year, the first of which traders expect in June.24 While rate cuts would certainly help support the American economy, they could also weaken the dollar and thus promote capital flow to foreign markets, potentially shrinking the valuation gap to a more sensible size.

Finally, while we do not expect geopolitical uncertainty to disappear anytime soon, the potential cooling of certain regional conflicts could also accelerate this trend. Because a “flight to quality” leads investors to prefer dollar assets during volatile periods, any progress on diplomatic talks in areas like Ukraine, the Middle-East, Taiwan, and the Chinese-Indian border would be welcome news for non-U.S. markets.

What This All Means for Investors

The preceding discussion provides an interesting intellectual exercise, but as investors, we ultimately need to translate these observations into practical investment decisions. Recently, our investment committee sat down to determine how the evolving global picture should inform optimal allocations right now, especially considering the Fed’s predicted rate cuts later this year.

First, we believe it makes sense to underweight China in the current environment. As it is the world’s second-largest economy, investors likely desire a sensible allocation to the country, especially considering its outsized influence in powering global growth over the past few decades.25 Due to the challenges facing China right now, however, below-benchmark exposure is prudent, especially considering the economic implications of a strained political relationship with the U.S.

Next, fixed-income portfolios should recognize the potential benefits of lengthening duration. Duration is a measure of a debt instrument’s exposure to rate changes, with longer-duration assets being more sensitive. While short-duration debt helped shield investors from the full pain of rate hikes, long-duration debt can help them take advantage of increases in value during the rate cuts expected this year, while reducing reinvestment risk in a falling rate environment.

Closely related to this, we have also decided to increase exposure to equal-weight equity indices. While capitalization-weighted indices (like the traditional S&P 500) include companies relative to their overall size, equal-weight indices divide exposure equally to each company. That means a greater representation of small- and mid-cap firms.

Like long-duration bonds, smaller companies tend to be more sensitive to changes in interest rates than larger ones.26 In fact, this consideration could be more important than ever. With the “Magnificent Seven” (Microsoft, Apple, Alphabet, Amazon, Nvidia, Meta, and Tesla) accounting for more than half the S&P 500’s rise in 2023, market concentration among big firms has neared its highest level in more than 50 years.27

Considering the elevated P/E ratios of the market’s largest companies, this move is also informed from a valuation perspective, as smaller companies are currently more reasonably priced when viewed through a P/E lens. In fact, the overall valuation level in American markets has also prompted us to reduce “home bias” in our portfolios, the term for the common investor preference to heavily allocate to their domestic market. While we continue to believe in the strength of U.S. markets and their capacity to outperform in the long term, we also believe that the valuation gap between the S&P 500 and foreign markets could be set for a reversion to the mean, driven by several possible catalysts.

As pragmatic investors, we recognize and readily acknowledge the difficulty inherent in making accurate short-term predictions in an environment as noisy as investment markets. At the same time, we aim to be vigilant in how we allocate portfolios and make the most of opportunities as they present themselves. As the trends we have discussed today play out, our investment committee will continue to monitor these situations closely, striving to position portfolios with intelligence and discipline. As always, should you or your family have any questions about this edition of Gerry’s Journal or your investment strategy, we invite you to reach out to our team today.

______________________________________________________________________________________________________________________________________

[1] Wall Street Journal, China Signals Opposition to Forced Sale of TikTok in the U.S. Link

[2] The White House, Readout of President Joe Biden’s Meeting with President Xi Jinping of the People’s Republic of China Link

[3] State Department, The United States Further Restricts Huawei Access to U.S. Technology Link

[4] Council on Foreign Relations, President Biden Has Banned Some U.S. Investment in China. Here’s What to Know. Link

[5] CSIS, Balancing the Ledger: Export Controls on U.S. Chip Technology to China Link

[6] Wall Street Journal, China Bans iPhone Use for Government Officials at Work Link

[7] Carnegie Middle East Center, Why China Is Emerging as a Main Promoter of Stability in the Strait of Hormuz Link

[8] Federal Reserve Bank of St. Louis, China’s Rapid Rise: From Backward Agrarian Society to Industrial Powerhouse in Just 35 Years Link

[9] International Monetary Fund, China’s Real Estate Sector: Managing the Medium-Term Slowdown Link

[10] Bloomberg, What’s at Stake as China Cleans Up Its Property Mess Link

[11] The Washington Post, China’s Evergrande is in trouble. But so is China’s top-down political economy. Link

[12] Bloomberg, What’s Wrong With China’s Economy? Can It Be Fixed? Link

[13] Financial Times, How China’s property crisis has unfolded, from Evergrande to Country Garden Link

[14] Retuers, What is China’s zero-COVID policy and how does it work? Link

[15] Bloomberg, China Youth Unemployment Rises in February After Data Revamp Link

[16] Council on Foreign Relations, China’s Population Decline Is Not Yet A Crisis. Beijing’s Response Could Make It One Link

[17] The Economist, China’s stockmarket nightmare is nowhere near over Link

[18] Bloomberg, China Academic Calls for $1.4 Trillion Stock Stabilization Fund Link

[19] Reuters, China’s 2023 GDP shows patchy economic recovery, raises case for stimulus Link

[20] JP Morgan, Guide to the Markets Q1 2024 Page 45 (PDF) Link

[21] JP Morgan, Guide to the Markets Q1 2024 Page 42 (PDF) Link

[22] MarketWatch, U.S. Dollar Index (DXY) Link

[23] AP News, Federal Reserve still foresees 3 interest rate cuts this year despite bump in inflation Link

[24] CME Group, FedWatch Tool Link

[25] International Monetary Fund, China Stumbles but Is Unlikely to Fall Link

[26] Voya Investment Management, A Historical Opportunity in Small Caps? Link

[27] Russell Investments, Market concentration and the Magnificent Seven: Where next? Link

The views contained in this presentation represent the opinions of GYL Financial Synergies, LLC as of the date hereof unless otherwise indicated. This and/or the accompanying information was prepared by or obtained from sources GYL Financial Synergies, LLC believes to be reliable but does not guarantee its accuracy. The report herein is not a complete analysis of every material fact in respect to any security, mutual fund, company, industry, or market sector. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Past performance does not guarantee future results.

CAR20240327GGTTGYL