From Russia Without Love

February 24, 2022

Today, our thoughts are with the people of Ukraine. They have lived through a very challenging period since the fall of the Soviet Union, and it is a sad reality that they must once again face the prospect of armed conflict and war.

This week, Russian aggression against Ukraine added a new layer of uncertainty and volatility to capital markets. This situation is very dynamic, and we want to provide our perspective on what has unfolded so far and some key themes we are monitoring. As always, we encourage you to connect with your GYL Advisor if you have questions about your wealth management strategy or would like to discuss these developments in greater detail.

The Conflict

On Monday of this week, Russian President Vladimir Putin recognized two regions in Ukraine as independent states — Luhansk and Donetsk — and ordered the deployment of Russian military forces as a means to “keep the peace.” 1 On Wednesday, Putin announced a military operation within Ukraine, which was followed by airstrikes aimed at Ukrainian military sites, airports, and government buildings. The cause for the attack, as stated by Putin, was to “demilitarize and de-Nazify Ukraine” — a rationale for invasion with very little merit. Bracing for a widespread invasion, Ukrainian President Volodymyr Zelensky mobilized the full force of the nation’s military and announced plans for the government to provide citizens with arms. 2

At the time of publication, the response from the United States and NATO allies has been diplomatic in nature. Specifically, a first set of sanctions were announced targeting Russia’s financial sector and its ability to import industrial technologies. 3 In response to the attack by Russia late Wednesday evening, global equity markets opened the day down 2% to 3% 4 on Thursday while Crude Oil futures pushed above $100 for the first time since 2014 5 .

Today, our thoughts are with the people of Ukraine. They have lived through a very challenging period since the fall of the Soviet Union, and it is a sad reality that they must once again face the prospect of armed conflict and war.

The Historical Context

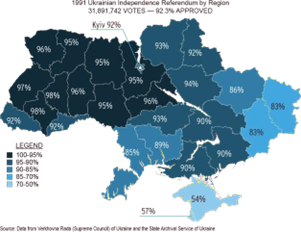

In any pivotal moment, it is valuable to consider the context of current events. The modern history between these nations begins in 1991 when 92% of Ukrainians voted for independence from the Soviet Union. As the map at right demonstrates, support for independence was strongest in Western Ukraine and waned (slightly) moving East toward the Russian border. 6

Following independence, Ukraine established formal relations with the North Atlantic Treaty Organization (NATO) 7 , which was formed in 1949 to provide member states with defensive support against incursions by the Soviet Union 8 . While Ukraine is not a full-fledged NATO member, it is considered an “Enhanced Opportunities Partner” of the organization. 9

In 1994, the Budapest Memorandum on Security Assurances was signed by six nations: Ukraine, Russia, Kazakhstan, Belarus, the United States, and the United Kingdom. In this agreement, Russia agreed to “respect the independence and sovereignty and the existing borders of Ukraine and to refrain from the threat or use of force against [Ukraine]”. In exchange, Ukraine agreed to give up its nuclear arsenal which was the third largest in the world at the time. 10

Notwithstanding the commitments that were made by Russia in 1994, in 2014, Russia “annexed” a portion of Ukraine, the Crimea Peninsula. This annexation occurred after months of political unrest across Ukraine which culminated in President Yanukovych fleeing the country to Russia and Ukraine’s Parliament installing an interim government. This interim government was declared an “illegal coup” by Russia, leading Vladimir Putin to send in military forces and establish checkpoints within Crimea. Roughly one month later, with Russian soldiers on the ground, a public referendum was held in Crimea to secede from Ukraine and join Russia. The measure passed with 97% voting in favor — a figure which is still widely disputed — and Putin then announced that Crimea was part of the Russian Federation. 11

Capital Market Implications

As mentioned, this situation is rapidly evolving, and the implications will be shifting as the scope of this conflict becomes clearer. With that said, what follows is a preliminary list of key factors that we are monitoring:

- European Energy Prices

Roughly a third of natural gas and one-quarter of all oil consumed in the European Union comes from Russia. 12 Prior to this week’s Russian attack on Ukraine there were concerns of a budding “energy crisis” within Europe — with the average home electrical and gas bills increased by 54% from 2020 to 2022. 13 Consumer spending is a key driver of economic growth, and significantly higher energy costs resulting from a prolonged conflict could represent a headwind for economic growth within the European Union and has broader implications for the global economy.

- Domestic Political Landscape

Similar to the challenges that many leaders in the European Union are facing, this situation comes at a difficult time for President Biden. On average, natural gas prices in the United States are up 36% since the start of the pandemic 14 and retail gasoline prices are up 45% 15 . One way to reduce the near-term spike in energy prices, and consequent associated inflationary pressure would be to stake out a more friendly posture with respect to fossil fuels to encourage and facilitate more supply. While this would likely help a lot of people weather the significant increases in costs associated with fueling their cars and homes, it would undoubtedly be viewed negatively by some of President Biden’s key constituents who are counting on the President to continue to move forward with policies aimed at reducing greenhouse gas emissions and our carbon footprint. This represents just one more challenge for the President to navigate. With a midterm election coming up in November, the White House is likely feeling pressure to “thread the needle” on not just energy policy but also as it relates to sanctions or military action which could add further inflationary pressures already impacting U.S. consumers.

- Fed Policy Response to Inflation

The Federal Reserve has a dual mandate of providing for “price stability” and “maximum

employment”. Price stability has been defined as an average of a 2% inflation rate. With inflation running at 7.5%, the Fed has made it clear that it will start taking steps to bring down the rate of inflation. Inflation can be driven by excess demand or by limited supply of goods and services. Unfortunately, a significant portion of the recent inflation is being caused by supply chain interruption. An anecdotal example of this is the limited availability of computer chips necessary for most machines that are produced today including cars and appliances. If a flare up of hostilities between Russia and Ukraine causes an interruption in the flow of natural gas and other fossil fuels and raw materials to Europe, this will exacerbate global inflationary pressure. While it would be a fool’s errand to underestimate the creativity and power of the Fed to develop a wide range of policy tools, the most conventional tools that are in its toolbox (such as adjusting the Fed Funds Rate) have proven to be particularly effective with reigning in demand driven inflation. However, this will not address supply chain issues and other constraints on goods and materials necessary for the global economy. Furthermore, with the exception of a brief period between 2017-2019, the quantitative easing programs that were first introduced in 2008 that resulted in a significant expansion of the Federal Reserve’s balance sheet have never been unwound. In other words, the potential for Fed Reserve policy error is greater as it moves policy to a less accommodative state.

Closing Thoughts

As it relates to the market volatility we have been experiencing, I am reminded of a quote which has been attributed to Benjamin Graham: “In the short run, the market is a voting machine, but in the long run it is a weighing machine.” Markets are news-driven and erratic during the short-term but work to determine the fair valuation for a given quantity of earnings over the long-term. This situation is still very new and developing rapidly. Accordingly, we would expect volatility to continue in the coming days as the “voting machine” continues to digest news and updates related to the situation in Ukraine.

Now more than ever, our team is here to help guide you and your wealth through this period of volatility. If you have any questions about the situation in Ukraine or your long-term wealth management strategy, we invite you to connect with your GYL Advisor.

1 Reuters, Putin orders troops to Ukraine after recognizing breakaway regions (Link)

2 Wall Street Journal, Russia Attacks Ukraine, Drawing Broad Condemnation (Link)

3 Wall Street Journal, U.S. Allies Poised to Hit Russia With Broad Sanctions for Ukraine Invasion (Link)

4 Wall Street Journal, Markets (Link)

5 Bloomberg, Brent Oil Jumps to $100 a Barrel on Russia-Ukraine Tensions (Link)

6 Brookings, 10 maps that explain Ukraine’s struggle for independence (Link)

7 NPR, 3 decades of turmoil bring Ukraine to perhaps its greatest crisis (Link)

8 U.S. Department of State, North Atlantic Treaty Organization (NATO), 1949 (Link)

9 Radio Free Europe, NATO Grants Ukraine ‘Enhanced Opportunities Partner’ status (Link)

10 U.S. Department of State, The States of Russian Aggression for Ukraine and Beyond (speech) (Link)

11 NPR, 3 decades of turmoil bring Ukraine to perhaps its greatest crisis (Link)

12 Council on Foreign Relations, Russia’s Energy Role in Europe: What’s at Stake With the Ukraine Crisis (Link)

13 The Economist, Europe’s energy crisis will trigger its worst neuroses (Link)

14 U.S. Bureau of Labor Statistics, Utility (piped) gas per therm in U.S. city average, average price, not seasonally adjusted (Link)

15 U.S. Energy Information Administration, U.S. All Grades All Formulations Retail Gasoline Prices (Link)

The views contained in this presentation represent the opinions of GYL Financial Synergies, LLC as of the date hereof unless otherwise indicated. This and/or the accompanying information was prepared by or obtained from sources GYL Financial Synergies, LLC believes to be reliable but does not guarantee its accuracy. The report herein is not a complete analysis of every material fact in respect to any security, mutual fund, company, industry, or market sector. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Past performance does not guarantee future results.

CAR20220224FRWLGJ