Three Challenges in Sustainable Investing

November 22, 2023

In GYL’s fourth issue of our quarterly newsletter published last fall, we included an article entitled “What is Sustainable Investing?” which discussed the various definitions of sustainability, including sustainability as a property of a system, corporate sustainability, and socio-ecological sustainability. We made the case for why some investors may wish to consider sustainable investing as a viable option to meet their financial goals. In this essay, we will examine three challenges investors may face in trying to implement a sustainable portfolio, including a limited selection of funds, potentially higher fees, and a higher baseline tracking error from category benchmarks. To recap, sustainable investing is an investment modality that combines values-based exclusionary/inclusionary screens and environmental, social and governance investment research, which analyzes systemic risk factors in the broader political-economy and within companies. The financial services industry often uses the terms “sustainable investing” and “ESG investing” interchangeably, but asset managers can integrate ESG data in conventional products. In the context of this writing, ESG funds refer to portfolios with an ESG mandate in portfolio construction, or portfolios that otherwise have certain ESG process or quality requirements.

While there are excellent sustainable investment funds on the market, the universe for selection is far smaller than the universe of conventionally managed assets. According to Morningstar Direct, there are nearly 10,000 unique mutual funds and exchange trade funds available in the United States market as of October of 2023. In contrast, Morningstar Direct indicates there are roughly 650 unique ESG mutual funds and exchange-traded funds for sale on the US market. Therefore, limiting investment selection strictly to funds with an ESG focus reduces the investable universe of comingled vehicles by 93%. For some investors that will not matter – one can have a diversified portfolio with a single balanced fund. For institutional investors and advisors, the relative paucity of selection can be a challenge. Morningstar data reveals that certain broad asset classes, such as large cap blend equity or intermediate core bonds, have comparatively more ESG funds than more specialized offerings, such as large cap value equity or high yield fixed income. GYL believes that the overall composition of an ESG portfolio should reflect a socially conscious approach, and we actively seek to improve our portfolios ESG profile. Simultaneously, we remain highly selective of the managers that we include, and not every ESG-focused option that fits an asset class passes muster. In constructing GYL’s ESG model portfolios, certain asset classes have historically led us to select funds which are ESG-integrated, meaning that the managers consider ESG data and principles, but have no defined sustainability requirements. In these cases, we engage with the managers and document whether they are using ESG analysis as a tool in portfolio construction. Each manager will have their own processes and view of sustainable investing, even among ESG-focused managers. Avoiding situations where “the best becomes the enemy of good” when it comes to ESG is critical to our process and may not satisfy everyone. Over time, we do believe the selection of investments with a sustainability-mandate will expand, but for now, advanced ESG portfolio construction often requires additional creativity and flexibility.

For investors who are very fee-conscious, higher expenses can be a barrier to sustainable investing. As many investors are aware, actively managed strategies tend to cost more than passively managed funds. Even within the same asset class, asset management fees can vary substantially. It is important to remember that although fees are an important consideration, the absolute lowest fee product is not necessarily the most appropriate choice. Where matters become a bit more challenging are in the realm of index funds, particularly when one index fund is just a flavor of another. There are low-cost investments in the world of ESG index funds, though they may command a premium when compared to their vanilla counterparts. For example, the SPDR S&P 500 ESG ETF has an expense ratio of ten basis points, whereas the SPDR Portfolio S&P 500 ETF has an expense ratio of two basis points. Whether that spread is worth it to you will depend on two questions – 1) Will you sleep better at night and be more likely to stay the course with the ESG factor? and 2) Do you believe that ESG integration could improve your risk-adjusted performance over the long term? If the answer to these questions is yes, then paying eight additional basis points might be well worth it. If the answer to these questions is no, one must decide if they are willing to incur the added investment expense and potential opportunity cost to follow an ESG investment approach.

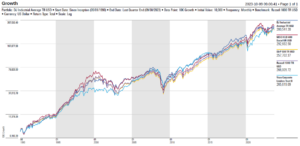

Finally, just as the availability of comingled products can be a hindrance for sustainable investors, so too can the restrictions within those products. Traditional theories of investment management suggest that, for any given opportunity set, it is preferable to have access to more components of that opportunity set than fewer. From this perspective, non-financial exclusions are a handicap to the investment manager, as they reduce the pool of opportunities, decreasing the managers capacity to diversify and generate excess return. If you measure risk in terms of tracking error from a benchmark, or the trend of an asset class, then the greater “active share” in an investment, the higher the likelihood is of significantly experiencing different performance than a traditional index over a given period. These variations can put an investor ahead or behind over the short to intermediate term though have historically coalesced in the longer term. As the chart below demonstrates, over the last 33 years, multiple different baskets of large cap US equity have still delivered similar absolute returns, whether it is 20 buy-and-hold positions selected back in 1935 (Voya), 30 committee-selected, price-weighted stocks (Dow Jones Industrial Average), a market-capitalization weighted index (S&P and Russell), or a classic ESG US index (KLD Social 400).

Logarithmic Total Returns of Five US Large Cap Indices/Passive Funds Between 5/1/1990 and 9/30/2023. Source: Morningstar Direct. Example inspired by Jeffrey Ptak and John Rekenthaler from Morningstar.

Granted, the ride investors experienced would look quite different at times, but through a consistent process one still arrived at approximately the same destination. This suggests that investment restrictions (within a reasonable scope) do not necessarily inhibit either indexes or skilled managers within the same category from delivering competitive returns. Of course, few investors make a single investment and leave it untouched for 33 years, so actual experiences are doubtless different and highly variable. Like any investment, for an ESG product, whether active or passive, the primary long-term risk is not underperformance, but of investor behavior derailing well-laid plans when the strategy is inevitably out of favor. For investors with the self-awareness that they may be uncomfortable, for instance, if their ESG portfolio temporarily underperformed a generic index due to restrictions on energy companies, then conventional assets exhibiting less tracking error might be more appropriate.

Like most facets of life, the debate between those who practice conventional investing or sustainable investing is not clear cut. As an advisory firm that does both, GYL views sustainable investing as an additional tool available to investors. Many investors who want to invest sustainably can feel more confident that yes, they can reach their goals while utilizing an environmentally and socially conscious investment process. At the same time, it is entirely possible to jump into sustainable investing without understanding that the implications for your portfolio may not always be positive. Recognizing both the benefits and challenges of sustainable investing can help increase your chances of success.

Disclosures:

The views contained in this presentation represent the opinions of GYL Financial Synergies, LLC as of the date hereof unless otherwise indicated. This and/or the accompanying information was prepared by or obtained from sources GYL Financial Synergies, LLC believes to be reliable but does not guarantee its accuracy. The report herein is not a complete analysis of every material fact in respect to any security, mutual fund, company, industry, or market sector. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Past performance does not guarantee future results.

CAR20231120GYLJCSI