More than half of people turning 65 this year will need some kind of long-term care in their lives, and an assisted living facility or home health aide costs around $50,000 per year.1 Due to the COVID-19 pandemic, older Americans face more health risks than usual, and the long-term effects of COVID could lead to a rise in the need for long-term care among older Americans.

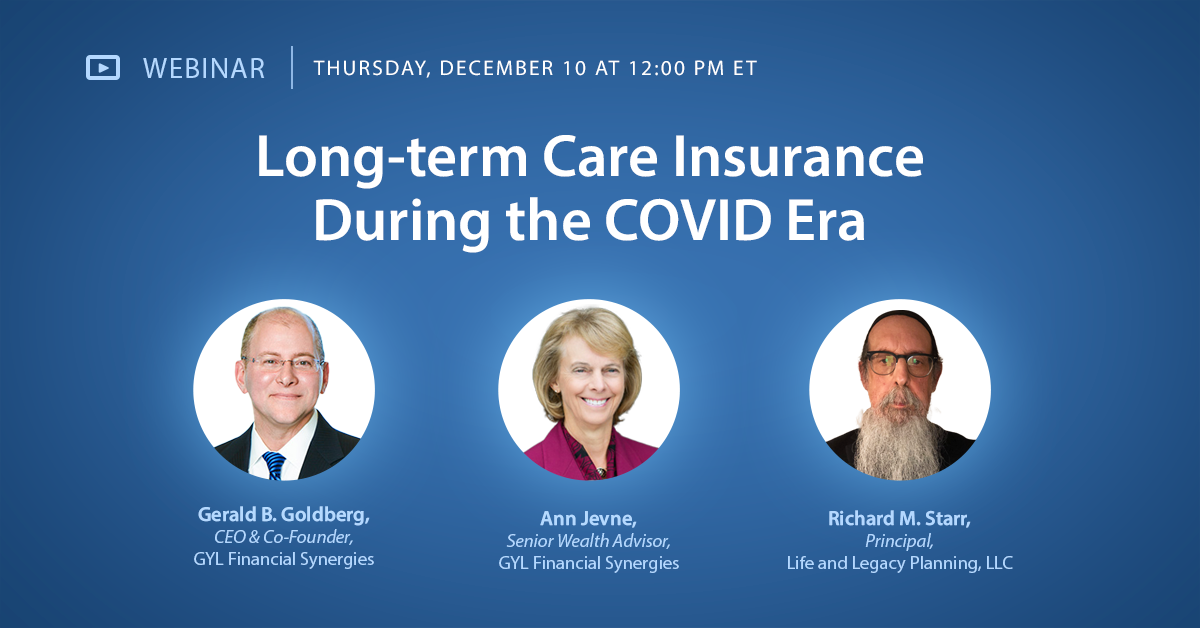

On Thursday, December 10 at 12PM ET, Ann Jevne, Senior Wealth Advisor at GYL Financial Synergies, LLC and Richard M. Starr, Principal & Member of Life & Legacy Planning, LLC will participate in a discussion moderated by Gerald Goldberg, CEO and Co-Founder of GYL Financial Synergies, LLC regarding long-term care insurance and how the COVID-19 pandemic could potentially change the long-term care landscape. Specifically, Ann and Richard will cover:

- The role of long-term care insurance

- The rising cost and changing landscape of long-term care across the country, particularly during COVID-19

- How long-term care impacts your finances and your family

- Essential features and benefits that should be considered when purchasing long-term care insurance

Register for this webinar:

Meet the Presenters

Richard M. Starr, J.D., LL.M., CLU

Richard is a Principal of Life and Legacy Planning, LLC, where he provides consulting services to financial services enterprises, brokerage firms, annuity service organizations and professional advisors. Richard’s areas of consultation and support include annuity and insurance, financial and wealth transfer planning, estate, business, gift, and retirement planning, and trusts and trust planning. Richard has been a premiere keynote subject matter expert and speaker for key meetings of financial planners, wholesalers, “brokers,” wire house, distribution partners, in all these areas of consultation. He has authored articles and white papers for wholesaler and broker use on advanced estate, business, insurance, and retirement planning topics and tools.

Richard has held senior attorney positions in advanced marketing departments of major insurers responsible for supporting key distribution partners in areas of estate, business, gift, retirement, philanthropic estate/charitable giving, tax planning, and annuity and insurance planning. Richard graduated with a B.A.in Psychology from the University of Pennsylvania and obtained his JD from Boston College Law School. He has an advanced degree in taxation (LL.M) from Boston University School of Law. He also has the Chartered Life Underwriter certification.

Ann Jevne, CPA, PFS, CFP®, AEP®

Ann joined GYL Financial Synergies in 2007. Her expertise is in the areas of portfolio management and financial planning. Ann regularly works with clients to provide them with a comprehensive analysis and evaluation of their financial needs including investments, tax, estate planning, retirement goals, insurance, and cash flows. Ann is a Certified Public Accountant, a Certified Financial Planner™, a Personal Financial Specialist, and an Accredited Estate Planner®. She has over 35 years of public accounting experience as well as financial planning experience as a partner of the accounting firm, Schwartz & Hofflich LLP, CPA.

Gerald Goldberg, JD, CIMA®

Gerry is the CEO and Co-Founder of GYL Financial Synergies, where he provides consulting services to corporations, municipalities, self-insurance funds, non-profit organizations and high-net-worth private clients in areas that include investment policy, asset allocation and investment management selection and oversight. He also advises clients on the structure and development of qualified retirement plans. Gerry lectures and authors articles on various investment-related topics, and has served as an adjunct professor in the MBA Program at the University of Hartford.

1 Morningstar, Must-Know Statistics About Long-Term Care: 2019 Edition. (Link)