Unspoken Truth: America’s Growing National Debt

October 29, 2024

By Gerald B. Goldberg, JD, CIMA®, CEO, and Co-Founder

In the run-up to this year’s U.S. presidential election, many political issues have been discussed to the point of fatigue. But throughout the campaign, one serious topic has gone largely unaddressed: the national debt.

A recent report from the Congressional Budget Office (CBO) found that the current level of U.S. government debt held by the public amounts to 99% of our country’s annual economic output, significantly above its historical average.[1] By next year, the CBO expects this figure to exceed 100% for the first time since the U.S. military expansion in the run-up to World War II.

Despite this astounding level of debt, neither presidential candidate appears to be taking the issue seriously. The national debt was not discussed at the September debate, and neither candidate’s policy documents make any more than passing references to the topic.[2] In fact, analysis from the non-partisan Committee for a Responsible Federal Budget found that the election of either candidate would likely add trillions to the national debt.[3]

In this edition of Gerry’s Journal, we will explore the risks associated with America’s outsized national debt and describe potential ways to correct our fiscal course. Doubtless, government finances can be a contentious political topic. Ensuring that we are not mortgaging our children’s future, however, should be a goal that transcends party division.

The state of play: Deficits & Debt

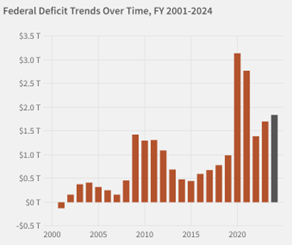

Before we can understand the risks of the national debt, it helps to take a step back and understand how we arrived at our current fiscal state. Just like a household, the government accumulates debt when it runs a deficit (spends more than it earns). Unlike most households, though, the government has run a deficit every year since 2001. In the most recent fiscal year, this deficit amounted to $1.83 trillion, meaning that about 27% of government spending was debt-financed.[4] So long as spending continues to outstrip tax revenue, the national debt will continue to climb.

Source: U.S. Treasury

Unfortunately, commonly cited measures of the national debt can misstate the true scale of the problem. On paper, the U.S. government currently owes about $35 trillion in debt, largely comprised of Treasury bills, notes, and bonds.[5] There are significant liabilities not accounted for in this traditional measure of debt, however.

In their fiscal report for 2023, the U.S. Treasury found that the government’s future Social Security & Medicare obligations are underfunded by about $78 trillion (in today’s dollars).[6] Not including this figure in the debt is like a pension plan that ignores mandatory future payouts when calculating its financial statements.

While the government may not pay interest on these unfunded obligations, they are just as much a genuine liability as Treasury bonds are. In total, these two figures bring the true value of the national debt to approximately $113 trillion. In comparison, the U.S. government brought in just under $5 trillion in revenue last year, highlighting the significant gap between what we owe and what we earn.[7] Judging by the CBO’s latest projections, this is not a situation that looks set to change without deliberate action. Under their baseline scenario, the federal deficit is expected to climb to more than $2 trillion annually by 2030.1

The risks: “Dedollarization” & “Slowbalization”

Based on these figures, it may seem surprising that the U.S. has not encountered significant debt challenges already. Currently, however, our debt is sustainable for one specific reason: robust global demand for U.S. Treasuries. Foreign actors (including both central banks and private investors) currently hold about $8.5 trillion of the $22.7 trillion of Treasuries outstanding.[8]

So long as global investors are willing to purchase Treasury securities, the U.S. government will be able to continue financing its deficits and repay its maturing debt. The situation is not dissimilar to a household taking out a new credit card each month to pay off last month’s bill (and finance even more spending).

Given the very public figures we have discussed, it may seem odd that foreign investors are willing to continue purchasing U.S. government debt. For the most part, however, many of these actors have little choice in the matter.

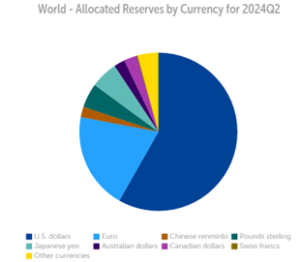

The U.S. dollar is currently the world’s reserve currency, with nearly 90% of all foreign exchange transactions denominated in dollars.[9] The result is that many countries (especially major exporters like Japan and China) end up with huge dollar stockpiles thanks to their trading activity.

Since these dollars need to go somewhere, they largely end up invested in U.S. Treasuries, one of the few capital markets deep enough to handle this scale of demand. Today, nearly 60% of all global foreign central bank reserves are held in dollar-denominated assets.[10]

Source: International Monetary Fund

While the current structure of the global monetary order makes America’s debt position sustainable today, this is not a situation that we can take for granted. Although the risks of full-scale deglobalization appear to be overstated, so-called “slowbalization” is already taking shape. As trade becomes less free, rising levels of tariffs and protectionism are making the world economy increasingly geographically fragmented.[11]

Pair this with America’s willingness to employ our control of the dollar system to its advantage (most notably by freezing $300 billion of Russian assets in 2022) and the incentives for non-Western aligned countries to transition away from the dollar have never been greater.[12] The BRICS countries (Brazil, Russia, India, China, and South Africa) already account for a greater share of global GDP than the G7.[13] A coordinated effort by the group to denominate trade in another currency could be a substantial step toward “dedollarization” – and thus away from Treasuries.

If foreign demand for Treasuries were to drop significantly, the U.S. could face serious challenges in financing its deficits. To induce buyers, we may need to offer higher and higher interest rates on Treasuries. These rising interest expenses would further imperil our financial position by requiring ever-greater Treasury issuance in an unsustainable debt spiral.[14]

All this is not to mention the other sources of risk facing the dollar system, including concerns about the declining credit quality of U.S. Treasuries and the rise of stablecoins. We have discussed both topics, explaining how they risk the dollar’s reserve status, in previous editions of Gerry’s Journal.[15]

Individually, none of these risks pose an immediate threat to the stability of our national debt. The accumulation of these risks, however, should make our pursuit of a more secure system that much more urgent.

The solutions: Pragmatism & Prosperity

I have painted what may seem a bleak picture of the fiscal risks facing our country. While these risks are very much real, they are also far from inevitable. Rather than shrink into pessimism, these risks should motivate us to pursue a more sustainable financial position through a balanced budget and possibly even a fiscal surplus.

The first step to solving this problem is to acknowledge that it exists. In recent years, the national debt has been a third rail of U.S. politics. Conscious that previous proposals to shrink the debt have been associated with unpopular austerity measures, lawmakers have been unwilling to broach the topic with voters.

Sticking our metaphorical heads in the sand, however, is simply not a pragmatic solution to this challenge. While cost-cutting measures are unpopular, politicians owe it to their constituents to be honest about the sustainability of programs like Social Security & Medicare. The unfortunate reality is that these programs were designed for a world that no longer exists.

In 1940, five years after Social Security was introduced, the remaining life expectancy for a 65-year-old was about 13 years for men and 15 years for women.[16] Today, those figures have climbed by 4 and 5 years, respectively.[17] While those increases may seem moderate on an individual basis, they are astronomical at the population level.

This is not an argument for taking away benefits from those who have already earned them. Rather, it is an argument for adjusting future payouts for those who have not already bought into these programs. When combined with encouraging possibilities for healthcare cost containment, these policies could go a long way to reducing the debt needed to finance future payouts.[18]

Perhaps even more contentious than entitlement reform, however, is the revenue side of the equation. While any discussion of taxation brings out activists from both sides of the aisle, there are viable ways to boost the U.S. tax base without any need to adjust marginal tax rates.

Through taxation, the government takes a piece of the overall pie that is the U.S. economy. Rather than increasing the share of the pie owed to the government, a much more fruitful (and politically viable) way to boost government revenue is to simply expand the size of the pie. While that may seem trite, the sheer scale of America’s economy means that even small boosts to growth can result in a tremendous increase to the tax base.

Ultimately, any country’s economic output comes down to just two variables: people and productivity. Therefore, there are only two ways to grow an economy – add more people, or make each individual person more productive.

Viewed through this lens, some natural solutions emerge for growing America’s economy. If history is any guide, encouraging higher birth rates through monetary incentives is an ineffective strategy.[19] Expanding legal pathways for high-skilled immigrants to live and work in the U.S., however, could be much more viable.

In terms of productivity, current technological trends should give us plenty of reasons to be optimistic. Doubtless, expanding use of artificial intelligence (AI) will lead to sectoral labor disruption, not unlike the decline in artisan weavers after the introduction of the Spinning Jenny during the Industrial Revolution. In the long term, however, AI could dramatically enhance worker productivity, with one study by Harvard Business School researchers postulating a 40% boost in productivity for white-collar workers.[20]

So far, politicians have been unwilling to honestly discuss our national debt for fear that measures to balance the budget will prove too painful to voters. As these examples demonstrate, though, sensible changes can be made that may not require much sacrifice at all. In any case, leaving the situation as-is and waiting for the aforementioned risks to materialize may end up being the most painful path of all.

Adults in the room

As many parents will tell you, young children often think that money grows on trees, spotting a new toy or video game and immediately begging their parents to buy it. It is only when we grow up that we realize that money is a finite resource and that such purchases involve a genuine budgetary tradeoff.

This level of responsibility is something that we ought demand from our employers, our local governments, and ourselves. And yet, the federal government seems unique in being able to escape this responsibility, living beyond its means for years without significant electoral pushback. As educated citizens comfortable with budgetary tradeoffs in our own lives, it is past time that we expect the same level of accountability from our elected officials.

Caring about this issue is not merely borne out of self-interest. The more and more money we borrow to finance current consumption, the greater the burden we leave our children’s generation. One day, they may find out that money does not grow on trees when they are expected to repay the sizable debts of their ancestors. With deliberate policy changes and honest debate, however, we still have time to avoid this outcome.

As this year’s U.S. election draws near, I encourage all eligible voters to exercise their democratic right and cast a ballot. The challenges facing our country, including the national debt, cannot be solved with apathy. As always, should you or your family have any questions about this edition of Gerry’s Journal or your investment strategy, I invite you to reach out to our team today.

The views contained in this presentation represent the opinions of GYL Financial Synergies, LLC as of the date hereof unless otherwise indicated. This and/or the accompanying information was prepared by or obtained from sources GYL Financial Synergies, LLC believes to be reliable but does not guarantee its accuracy. The report herein is not a complete analysis of every material fact in respect to any security, mutual fund, company, industry, or market sector. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. This document contains forward-looking statements, predictions, and forecasts (“forward-looking statements”) concerning our beliefs and opinions in respect of the future. Forward-looking statements necessarily involve risks and uncertainties, and undue reliance should not be placed on them. There can be no assurance that forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Past performance does not guarantee future results. CAR20241029GYLGGOCT

[1] Congressional Budget Office An Update to the Budget and Economic Outlook: 2024 to 2034 Link

[2] Financial Times Harris and Trump are equally silent on the expanding US debt Link

[3] Committee for a Responsible Fiscal Budget The Fiscal Impact of the Harris and Trump Campaign Plans Link

[4] U.S. Treasury National Deficit Link

[5] U.S. Treasury U.S. Treasury Monthly Statement of the Public Debt Link

[6] U.S. Treasury Financial Report of the United States Government Fiscal Year 2023 Link

[7] U.S. Treasury Government Revenue Link

[8] U.S. Treasury Major Foreign Holders of Treasury Securities Link

[9] Atlantic Council Dollar Dominance Monitor Link

[10] International Monetary Fund Currency Composition of Official Foreign Exchange Reserve Link

[11] International Monetary Fund Charting Globalization’s Turn to Slowbalization After Global Financial Crisis Link

[12] Reuters What and where are Russia’s $300 billion in reserves frozen in the West? Link

[13] Banque De France Expansion of BRICS: what are the potential consequences for the global economy? Link

[14] Bloomberg US Faces ‘Unsustainable’ Spiral of Rising Debt and Interest Costs Link

[15] GYL Financial Synergies The Fitch Downgrade and the Dollar’s Future Link, GYL Financial Synergies Untethering the Dollar: The Risks of a Stablecoin Future Link

[16] Social Security Administration Life Expectancy for Social Security Link

[17] Social Security Administration Actuarial Life Table Link

[18] Committee for a Responsible Budget 6 Ways to Reduce Health Care Costs Link

[19] Vox You can’t even pay people to have more kids Link

[20] SSRN Navigating the Jagged Technological Frontier: Field Experimental Evidence of the Effects of AI on Knowledge Worker Productivity and Quality Link