Untethering the Dollar: The Risks of a Stablecoin Future

June 7, 2024

By Gerald B. Goldberg, JD, CIMA®, CEO, and Co-Founder

As the 2024 U.S. presidential election approaches, one issue could have an unexpectedly influential impact on the result: crypto. With cryptocurrency prices back near all-time highs and the continued absence of substantial regulation, major candidates are beginning to signal their positions on the topic. Former President Trump’s campaign, for instance, is now accepting crypto donations.[1] Incumbent President Biden, meanwhile, recently vetoed a crypto-friendly bill, despite bipartisan support.[2]

While crypto might seem like a niche topic, independent polling indicates that about 17% of U.S. adults (or nearly 44 million people) have traded or invested in cryptocurrency at some point in time.[3] Moreover, crypto adoption is greater among young, non-white individuals, who are recognized as key swing voters this year.[4] With the upcoming election likely to be decided by a slim margin, crypto policy could be enough to give either candidate a decisive edge.

Unfortunately, this dynamic creates powerful incentives for candidates to base their crypto views on political gamesmanship, rather than responsible governance. Of course, opportunistic policymaking is nothing new in the world of American politics. Crypto’s overlooked influence on the global dollar system, however, means that short-sighted regulation could have unintended consequences for our nation’s economic future.

As an investment strategy, GYL’s policy on crypto remains unchanged. Like all speculative investments, cryptocurrencies are not a reliable wealth-building strategy, and should not comprise more than a small portion of an overall portfolio.

Crypto does not merely function as an investment, however. Certain digital tokens have also found use as a medium of exchange, and it is in this role that crypto could ultimately disrupt the dominance of the U.S. dollar.

Crypto as a currency: Understanding stablecoins

Classic cryptocurrencies, like Bitcoin and Ethereum, have notoriously erratic prices. Research from Fidelity Digital Assets indicates that Bitcoin has been at least 3.5 times more volatile than the S&P 500 in the recent past, with numerous years exceeding 100% realized volatility.[5]

Source: Fidelity Digital Assets

Other cryptocurrencies, however, try to eliminate volatility altogether. “Stablecoins,” as these tokens are known, aim to trade one-for-one in terms of a popular fiat currency like the U.S. dollar or the Euro. While stablecoins differ in how they maintain that fixed peg, the most robust approach is known as “collateralization.”[6]

To understand how collateralized stablecoins work, we can look to the dollar-based USDT token, the largest stablecoin by market cap.[7] When a user buys new USDT from Tether (the parent company that operates the stablecoin), Tether parks the user’s dollars in financial assets like Treasuries or short-term corporate loans.[8] Then, when users want to redeem their USDT, Tether converts a portion of those assets into dollars and returns the money.

Tether claims to have honored every customer redemption request so far, including during particularly volatile periods for the crypto industry.[9] As a result, the token has traded at almost exactly $1 in the secondary market for its entire history. Tether’s lack of transparency, however, has drawn consistent skepticism, with significant questions surrounding the makeup of its collateral portfolio.[10]

So far, regulators have made limited efforts to police Tether. In 2021, the New York Attorney General’s Office and the Commodity Futures Trading Commission each separately fined Tether for misleading investors about the nature of its holdings, with penalties totaling $61 million.[11] Still, regulatory oversight of Tether pales in comparison to that required of comparable products in the traditional financial system, such as money market mutual funds.

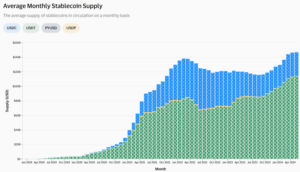

Originally, regulating the $160 billion stablecoin market lightly could be justified by the idea that these tokens merely facilitated payments within the crypto ecosystem. But as the collapse of once-hallowed crypto giant FTX shows, activities within this ecosystem can lead to real-world consequences and consumer losses.[12] Even more concerning, however, is growing evidence that stablecoins could replace the dollar as a payment mechanism in the real economy.

Adopting stablecoins could have consequences for U.S. economic prosperity

To date, stablecoins have seen limited use outside the crypto ecosystem.[13] Institutional payment providers, however, are laying the groundwork necessary to make stablecoins a feasible mechanism for both retail transactions and cross-border trade.

Last year, PayPal announced the creation of its own proprietary stablecoin PYUSD, which has since grown to a $400 million market cap.[14] Shortly after, Visa completed a successful transaction settlement pilot using the stablecoin USDC, issued by crypto firm Circle.[15] Just this year, Stripe, which facilitates more than $1 trillion in transactions annually, announced that it would allow customers to accept USDC as payment beginning this summer.[16]

Source: Visa Onchain Analytics[17]

As a payment method, stablecoins could offer some genuine advantages over the traditional dollar, such as near-instant settlement and greater funding transparency via the blockchain. And so far, institutional partners have eschewed working with the stablecoin issuers that appear to pose the greatest risk, like Tether. Still, the replacement of public money with private money could have significant consequences for our country’s fiscal and monetary outlook.

Today, the U.S. enjoys striking advantages from controlling the world’s preeminent reserve currency, an idea I discussed in the August 2023 edition of Gerry’s Journal.[18] Nearly 90% of foreign exchange transactions and almost 60% of foreign exchange reserves are denominated in dollars, which results in robust global demand for U.S. Treasuries.[19] As a result, the U.S. has the ability to debt finance government spending with lower interest rates and inflation than would otherwise be the case.

Consider a future in which a dollar-based stablecoin becomes the dominant currency for cross-border trade. Initially, the U.S. might continue to realize existing monetary benefits, since a responsible stablecoin issuer would still have to purchase an equivalent amount of dollar-denominated assets like Treasuries to collateralize their tokens.

But in this future, the U.S. would be exporting the responsibility of maintaining the stability of the global currency to these stablecoins. Rather than a system built around tightly regulated banks and the full faith and credit of U.S. government securities, this would be a system built on lightly regulated assets with a poor history of long-term reliability.

The most famous stablecoin crash in recent memory is that of UST in 2022, a token that once boasted a market cap of more than $18 billion.[20] But it is far from the only one. Blockchain security company ChainSec maintains an ongoing count of major failed stablecoins, which stands at 23 since 2014.[21]

Were a major cross-border dollar-based stablecoin to collapse, it could prompt a rapid reallocation to other currencies. If trading counterparties organize their transactions around the blockchain, it could be relatively simple to switch to a euro or yuan-based stablecoin in reaction to turbulence in a dollar-based stablecoin. Such an episode would be a windfall to countries like Russia and China, which have been making active efforts to “de-dollarize” their markets and undermine U.S. global economic leadership.[22]

Ultimately, that story might end with the dollar losing its status as the world’s preeminent reserve currency – and the U.S. losing the monetary advantages associated with that privilege. While the blockchain comes with certain benefits, these benefits are marginal relative to the benefits our nation accrues from controlling the dollar. Relinquishing that control to private companies with limited oversight and a poor track record would be an irresponsible gamble.

Sensible, deliberate regulation is needed

Of course, I have yet to mention the non-economic benefits associated with controlling the global reserve currency, most notably our nation’s ability to target authoritarians and despots with financial sanctions. Today, dollars flow through regulated banks and bond markets, allowing the U.S. to identify and disrupt payment flows to bad actors. Control of the dollar system has proven an important sanction tool in recent years, most notably against Russia.[23]

But in a stablecoin regime, underlying dollars may not even need to change hands. Instead, only tokenized dollars living on the blockchain would need to be transferred. While the blockchain is less anonymous than many assume, this dynamic would make it easier for targeted countries and individuals to evade U.S. sanctions while still leveraging the benefits of the dollar system.[24]

The preceding analysis is not meant to paint a stablecoin-dominated future in an inherently negative light. As I have mentioned, there could be valuable speed and cost benefits to a transaction system built on blockchain technology. But the potential risks demonstrate the importance of ensuring regulation stays ahead of the market, rather than the other way around.

With sensible regulations that ensure the stability of stablecoins and the transparency of payment flows, a tokenized future could be a boon to U.S. economic and political prosperity, rather than a threat. But achieving that future will take legislation built on a thoughtful, bipartisan approach, not political expediency and grandstanding.

There is some evidence that intelligent regulation is coming. The House recently approved the FIT21 bill, which clarified agency authority and established a framework for regulating digital assets.[25] But the bill’s future is highly uncertain, with the Senate showing little interest in advancing the legislation.[26]

As citizens, the best we can do is continue to encourage our elected representatives to proactively craft rules that allow us to benefit from emerging innovations, instead of ignoring those innovations until it is too late. We cannot and should not seek to throttle technological disruption – but we can at least ensure that disruption works to the benefit of our nation, rather than to its detriment.

As always, should you or your family have any questions about this edition of Gerry’s Journal or your investment strategy, our team stands by to assist you. Cryptocurrency and stablecoin use are expansive, evolving topics, and we would be happy to help guide your research and knowledge.

The views contained in this presentation represent the opinions of GYL Financial Synergies, LLC as of the date hereof unless otherwise indicated. This and/or the accompanying information was prepared by or obtained from sources GYL Financial Synergies, LLC believes to be reliable but does not guarantee its accuracy. The report herein is not a complete analysis of every material fact in respect to any security, mutual fund, company, industry, or market sector. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Past performance does not guarantee future results.

[1] AP News, Donald Trump’s campaign says it will begin accepting contributions through cryptocurrency Link

[2] The White House, A Message to the House of Representatives on the President’s Veto of H.J.Res. 109 Link

[3] Pew Research, Majority of Americans aren’t confident in the safety and reliability of cryptocurrency Link

[4] The New York Times, Trump Leads in 5 Key States, as Young and Nonwhite Voters Express Discontent With Biden Link

[5] Fidelity Digital Assets, A Closer Look at Bitcoin’s Volatility Link

[6] Bloomberg, The Crypto Story Link

[7] CoinMarketCap, Top Stablecoin Tokens by Market Capitalization Link

[8] Tether, Tether Whitepaper Link

[9] Tether, Understanding Tether’s Peg and Reserves Link

[10] The Verge, The Tether controversy, explained Link

[11] New York State Attorney General, Attorney General James Ends Virtual Currency Trading Platform Bitfinex’s Illegal Activities in New York Link

Commodity Futures Trading Commission, CFTC Orders Tether and Bitfinex to Pay Fines Totaling $42.5 Million Link

[12] AP News, A timeline of the collapse at FTX Link

[13] Centre for Economic Policy Research, Payment versus trading stablecoins Link

[14] PayPal Newsroom, PayPal Launches U.S. Dollar Stablecoin Link

[15] Visa Investor Relations, Visa Expands Stablecoin Settlement Capabilities to Merchant Acquirers Link

[16] TechCrunch, After 6-year hiatus, Stripe to start taking crypto payments, starting with USDC stablecoin Link

[17] Visa Onchain Analytics, Stablecoin Supply Link

[18] GYL Financial Synergies, The Fitch Downgrade and the Dollar’s Future Link

[19] Atlantic Council, Dollar Dominance Monitor Link

[20] CoinGecko, Stablecoin Statistics: 2023 Report Link

[21] ChainSec, Comprehensive List of Failed Stablecoins Link

[22] Congressional Research Service, De-Dollarization Efforts in China and Russia Link

[23] Carnegie Endowment for International Peace, How Sanctions on Russia Will Alter Global Payments Flows Link

[24] MIT Technology Review, Cryptocurrency isn’t private—but with know-how, it could be Link

[25] Financial Services Committee, House Passes Financial Innovation and Technology for the 21st Century Act with Overwhelming Bipartisan Support Link

[26] BakerHostetler, Digital Assets Legislation: House Passage of FIT21 Unlikely to Carry Momentum in Senate Link

CAR20240607GYLGG